Fund Accounting with NolaPro

Smarter, simpler nonprofit financial management

Create a Cloud Account

No Credit Card Needed

What is Fund Accounting?

Fund accounting is a method of bookkeeping used by nonprofits and government entities to track and manage resources that are designated for specific purposes. Each fund represents a self-balancing set of accounts, ensuring transparency and accountability. Proper fund accounting is essential for compliance, accurate reporting, and maintaining donor trust.

At NolaPro, we make fund accounting intuitive and powerful. Our platform is purpose-built to help nonprofit organizations stay organized, compliant, and confident in their finances—without the headaches of traditional accounting tools.

Try It Live

- Curious to see NolaPro fund accounting in action? Jump right into our live demo site and explore all the features for yourself. No account creation required, no setup hassle—just click and go!

- The demo environment resets every morning, so feel free to test, click around, enter transactions, create reports, or try out budgeting features without worrying about breaking anything permanently.

- Whether you're exploring fund balances, generating a Statement of Activities, or assigning department types, everything is ready for hands-on learning.

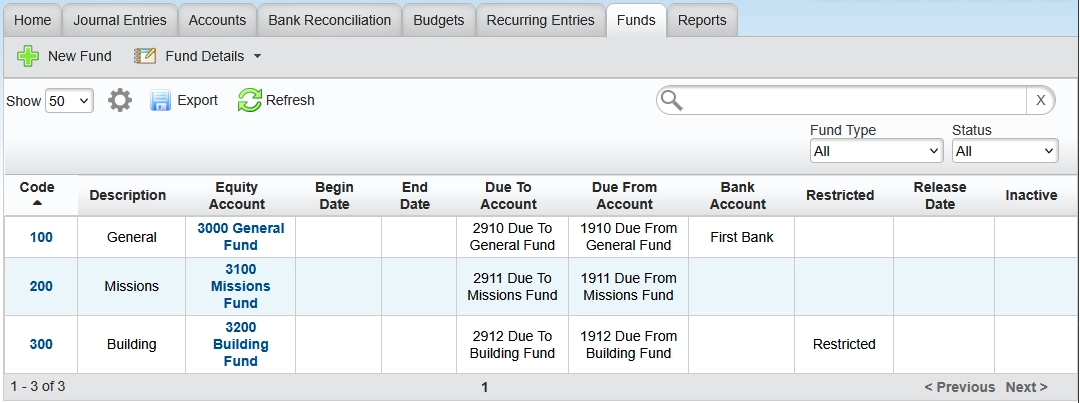

Funds

- Create restricted and unrestricted funds: Designate funding as restricted or unrestricted and track them separately with automatic rules and labels.

- Set release dates for restricted funds: Easily configure when restricted funds become available for use, ensuring compliance with donor and grantor conditions.

- Due To/Due From tracking: Seamlessly handle inter-fund transactions when one fund temporarily covers costs for another.

- Close individual funds manually: Wind down and archive specific funds without waiting for the fiscal year-end process.

- Drill-down fund balances: Click into fund balances to view the source records behind each amount for complete transparency.

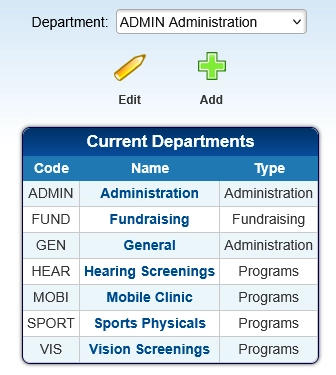

Departments

- Classify by purpose: Assign transactions to departments under the standard divisions of Programs, Administration, and Fundraising with just a few clicks.

- Statement of Functional Expenses: Instantly generate detailed reports that break down expenses by department to support your Form 990 filings.

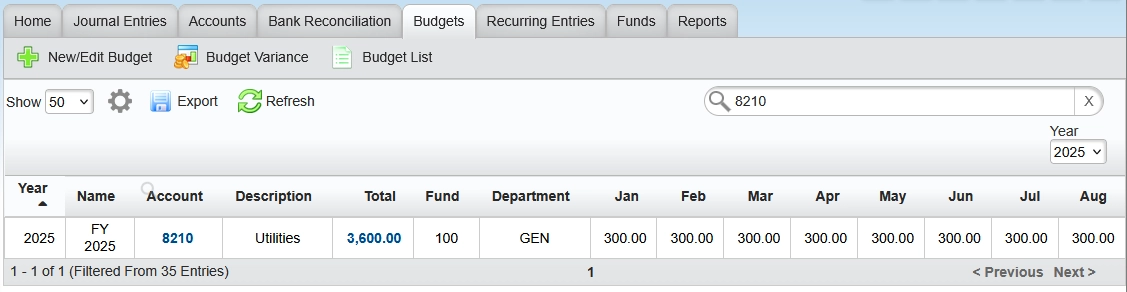

Budgets

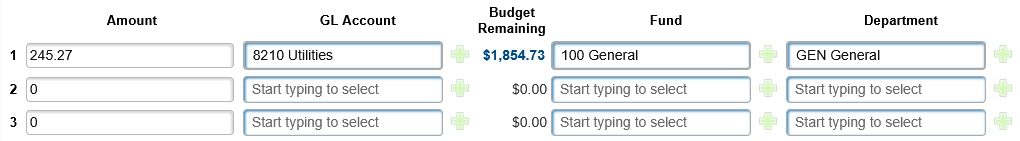

- Create annual budgets: Build precise budgets broken down by Fund and Department to align with your operational goals.

- Budget generation from past data: Use actuals from up to two prior years to quickly model new budgets.

- Budget variance reporting: Track how actual performance compares to budget in real time, throughout the year.

- Expense warning system: Receive alerts when entering vendor invoices that could push a fund or department over budget.

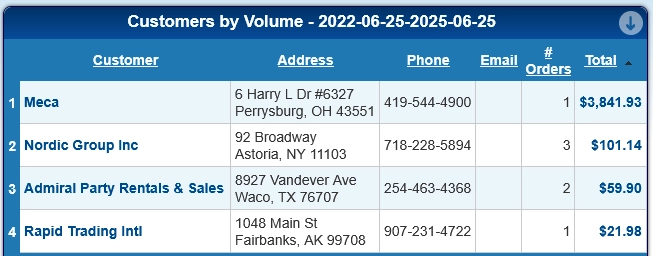

Donor Tracking

- Accept online payments from donors: Seamlessly integrate with payment gateways to receive gifts directly into your accounting system—automatically tagged to the correct fund.

- Annual contribution summaries: Run reports that consolidate donor giving over the year to generate thank-you letters or tax documentation with ease.

- Top donor reports: Instantly see who your most generous supporters are with ranked lists based on total contributions over a selected date range.

- Identify inactive donors: Generate lists of donors who haven’t given since a specific date to inform re-engagement or stewardship campaigns.

- Track new donors: Pull a list of new contributors by date range to welcome and onboard them with targeted messaging.

- Custom feedback forms: Create and send surveys to donors to gather feedback on your organization’s work and strengthen your relationships with supporters.

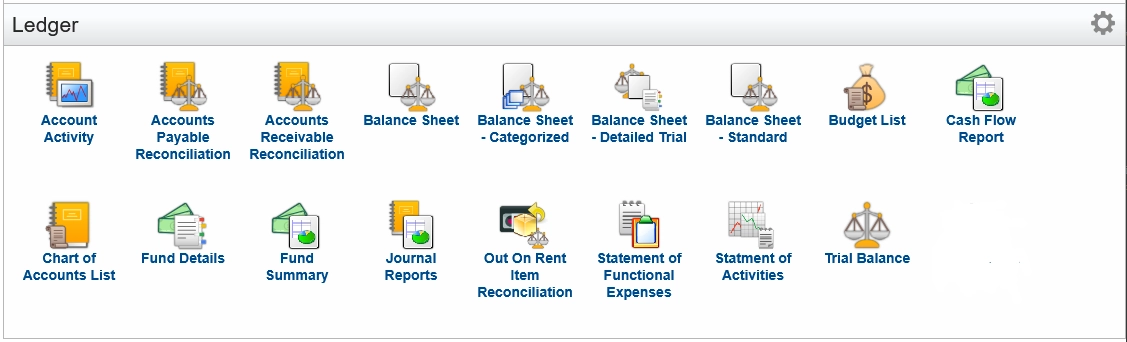

Reports

- Balance Sheet: Get a real-time snapshot of your organization’s financial position.

- Statement of Activities: See revenue and expenses over time, broken out by fund. Filter by fund and department to focus your view.

- Statement of Functional Expenses: Drill into how your organization allocates resources across core functional areas—key for IRS Form 990 prep.

Chart of Accounts

- One chart to rule them all: No need to duplicate accounts for each fund or department. Keep things streamlined and consistent.

- Granular GL-level tracking: Assign funds and departments at the transaction level for precision without complexity.

- Filtered reports: View financials by Fund, Department, or both—instantly and without running separate ledgers.

- Custom summaries: Group and summarize accounts however you need for board reports or internal presentations.